The Paradox of the Market ‘s Resolve

Key Takeaways

While geopolitical crises usually cause a short-term reaction in stock and bond markets, it is usually short-lived, with markets recovering quickly. (Unless it coincides with a recessionary period)

Financial markets and economic growth are influenced more by long-term trends and cycles instead of crises, events, or even wars — this is true for both stocks and bonds.

The world would not see an end to future conflicts and crises, and unless you are reaching your goal soon, then it is better to ride out the short-term volatility and stay the course.

The future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values.

— Warren Buffett

On 3 Jan 2026, Operation Absolute Resolve removed Nicolas Maduro of Venezuela. It’s a sensational development by any measure, a US military incursion to kidnap the president of a sovereign country. Nobody can be certain of the impending fallout, especially after Trump said that the US will “run” Venezuela, using “boots on the ground” if necessary. However, the US has a long history of direct (and indirect) involvement in regime change in South America, with the last US attack on a Latin American country being the 1989 invasion of Panama, which led to the overthrow of Manuel Noriega.

Given the multitude of surprises in 2025 coming from the US administration, markets hardly batted an eye during this invasion. One of the main reasons is that currently, the world is oversupplied with oil, and Venezuela, unfortunately, does not register very highly on the global economic stage. It currently represents less than 0.1% of World GDP and produces 1% of the world’s oil supply. As you can see below, the oil market hardly registered any movement over the past few days compared to the usual spikes we have seen during past conflicts.

However, we will be seeing more of this conflict in the news and headlines over the next few weeks, so it will be pertinent to address it as it brings about fear once again.

Financial strategists have a rule of thumb: that investors hate uncertainty more than anything. You may be surprised to know that situational uncertainty doesn’t always play out in stocks as many would have you assume. And of course, geopolitical crises can be disruptive to the global economy (and even financial market performance). However, a historical study of stock and bond markets shows that while there typically is a short-term reaction to that uncertainty, it is also a short-lived one, and that the markets recover quickly. Essentially, financial markets and economic growth are influenced more by long-term trends and cycles rather than by crisis events.

The chart below shows various crisis events overlaid on the S&P 500 index (which has a longer history than global stock market indices). These crises include wars, terrorist attacks, political coups, and even financial meltdowns. Regardless of the type of crisis, the market is “shocked” in the short-term, but recovers quickly unless the event occurs during a recessionary period (shaded area).

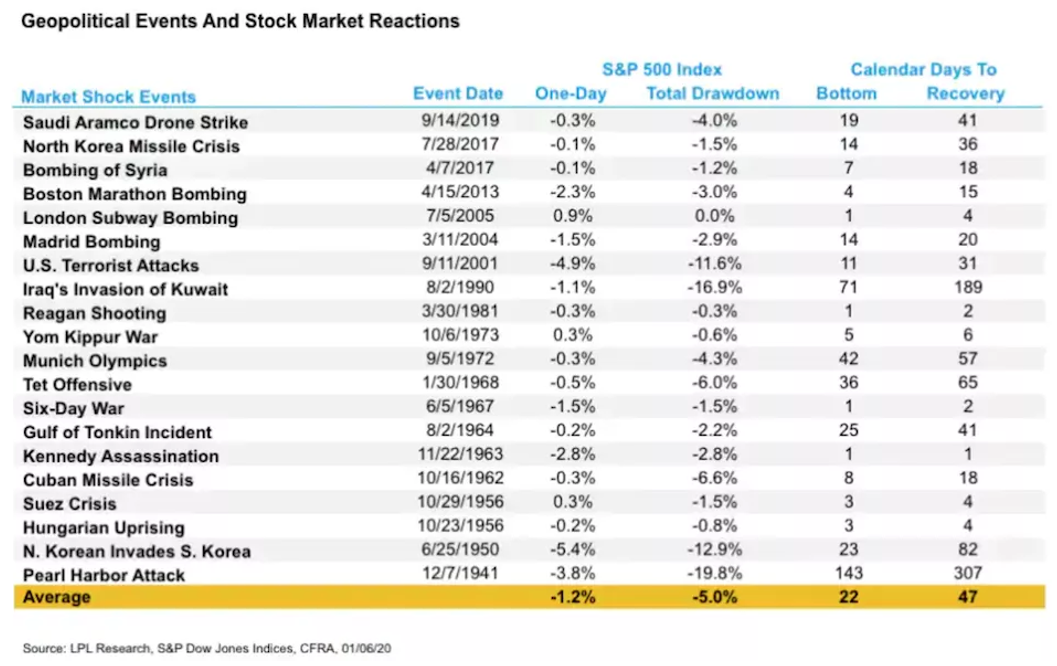

Looking at stock prices on a monthly basis (table below) — on average, the market has been unaffected up to a year after the crises. Post-crisis performance is significantly better when recessions are excluded. If history is any guide, then it is likely that the current conflict — occurring outside of a recessionary period, could lead to similar results.

The past outbreaks of wars or geopolitical specific events also tell a similar story. The longest recovery period was only nearly a year during 1941 — when the world and the US in particular were emerging from a recession where peak unemployment numbered nearly 20%.

Commentators have highlighted that this could be the start of a new global war. If so, what could be the possible impact on asset prices? Taking reference from a global war, we can see the impact of World War 2 on stock markets (using the DJIA as a representation) in the chart below. In his book “Wealth, War and Wisdom”, money manager Barton Biggs mused that during WWII, the war news was consistently bad, but nevertheless stocks worked higher - perhaps the U.S. stock market instinctively understood the significance of Midway, well before expert opinion or the conventional wisdom grasped its importance.

So this is a good reminder that uncertainty is always present — it will be hard to predict what could happen in the future. However, reacting to events is not a useful thing to do when it comes to your investments.

It is likely that we will see many more conflicts and crises in the future, and unless you are reaching your goal soon, it is better to stay the course. Ride out the short-term volatility and allow your well-constructed investment plan to guide you through uncertain times. It can be challenging to invest during such periods, but decades of evidence suggest it is the right thing to do.

In addition, a lot of the market data and information we track now does not suggest a risk of a global recession - something that would be more harmful for your investments. As such, things would likely be more smooth sailing than not for the time being.

If you would like to chat about this or your specific investments, come and speak to us.