Getting Wealthy vs Staying Wealthy — 2 Very Different Strategies

Wealth is largely the result of habit

Apart from the Malaysian elections, one of the hottest stories of late is likely to be the ongoing debacle in the cryptocurrency universe and the high profile collapse of one of the largest brokerages in the world, FTX. Of particular interest was the spectacular decline of the net worth of FTX’s founder Sam Bankman-Fried, where he lost 95% of his wealth in one day.

He is certainly not the first high profile individual to lose vast amounts of wealth in a short-span of time. Here are other notable examples.

Yasumitsu Shigeta, president of Hikari Tsushin and then Japan’s youngest self-made billionaire, was once worth $42bn but his wealth collapsed in a matter of months after the shares of his company lost -90% of its value during the dot-com bust.

Sean Quinn, Ireland’s richest man worth $6bn in 2008, was declared a bankrupt in 2012 with a debt of $3bn after losing everything and more in Ireland’s property collapse in 2008.

Eike Batista, at one time Brazil’s richest man worth $35bn self-proclaimed that he was on track to be the “richest person in the world”. He lost 99% of his wealth over two years in the wake of Brazil’s mining, oil and gas collapse and is now serving a 30 year house arrest sentence for bribery and other charges.

What do they have in common?

There are many other such cautionary tales but they all have a common recurring theme:

They get wealthy by concentrating ALL of their money into one or two investments. Maybe even amplifying their wealth by borrowing more money to do just that.

They destroy a large part of their wealth by leaving ALL of their money in those same investments. Destroying it further if they had leveraged in those investments.

Ok, so you may not be a billionaire, but you still want to ensure that your assets are preserved over time. So how do you ensure that your hard earned money, your family’s legacy and wealth does not go the way of these famous collapses?

A study by wealth consultancy William’s Group found that 7 out of 10 families lose their wealth by the second generation; by the time the money reaches the third generation, 9 out of 10 families have already lost it all. The major causes for such a significant decline pointed to:

A lack of common purpose for the wealth amongst family members — essentially a lack of a comprehensive investment plan.

Lack of next generation planning — educating the younger generation about proper investing tenets like diversification, asset allocation, and capital preservation.

Lack of succession planning — where the head of the household did not properly segregate and protect the family wealth, leading to infighting, divisions, and erosion of wealth through litigation, frivolous spending, and improper investing amongst the beneficiaries.

Diversification

Since 90% of wealthy families have lose all of their wealth by the third generation, what did the successful 10% do? For one, when it came to managing and investing the family assets, time-tested strategies worked the best. Whilst it was natural that the family still had a large amount of wealth tied up in the original business or entity that made them wealthy in the first place, they had divested quite a bit — into globally diversified, liquid investments which allowed their money to withstand the volatility and risks of the market.

On hindsight Sam Bankman-Fried, Yasumitsu Shigeta, Sean Quinn, and Eike Batista may secretly wish that they moved at least half of their money out from their concentrated holdings. This would ensure that they had at least a few billions leftover even if their businesses collapsed.

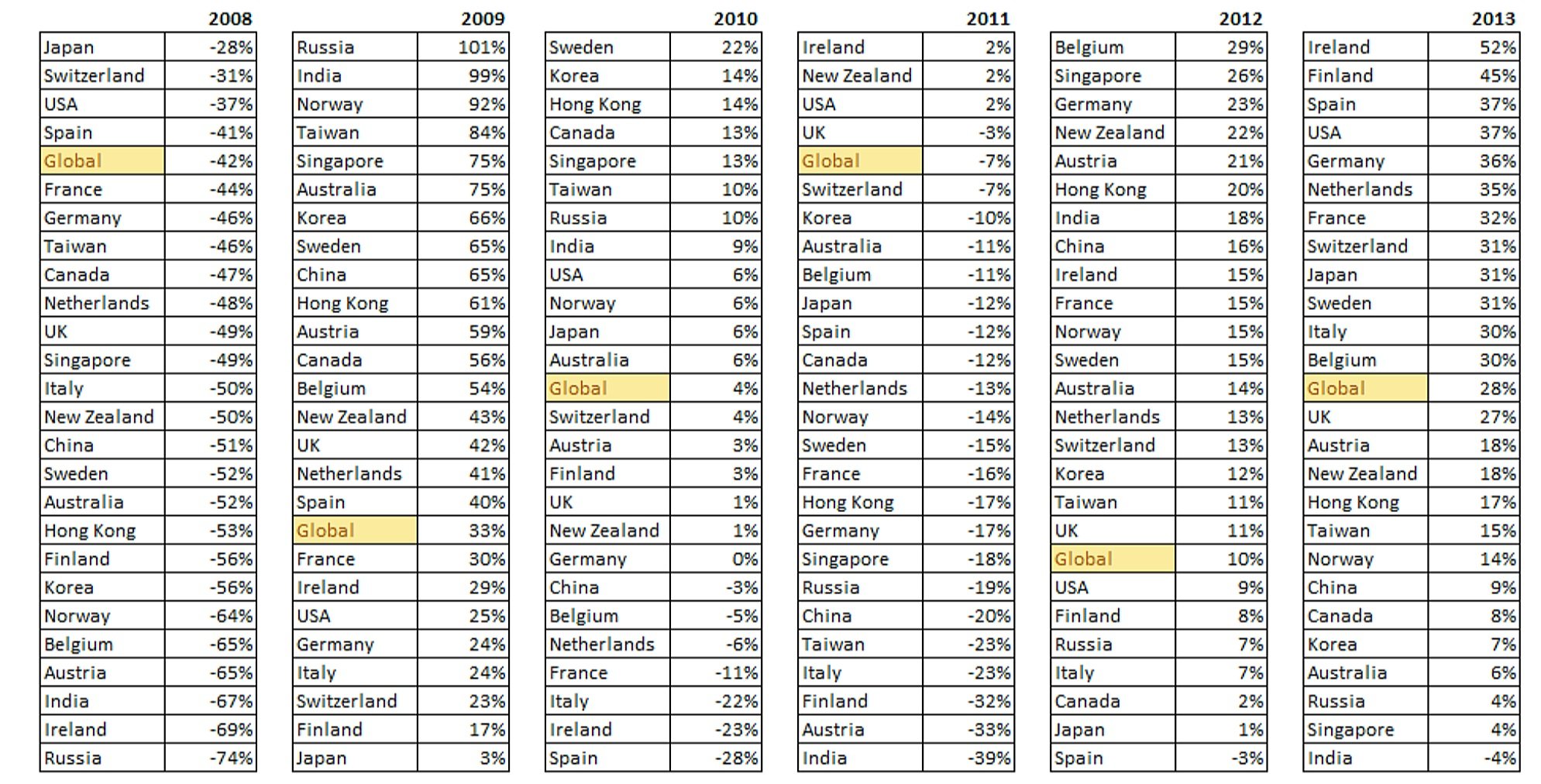

This concept of investing is shown in the following diagrams below — even when investing in the stock market of a single country, you will notice that there are vast variations between the top performing country and the worst performing country. If you have a lot of investments stuck in a certain company or region, the volatility that you experience would be quite great.

What about holding everything, a.k.a. the global stock market portfolio? You can see that it’s highlighted in yellow — it’s always somewhere in the middle, giving you a much more moderate ride.

And if you think having assets focused in one or handful of countries can’t be that bad, then have a think about Russian assets in 2022 - due to global sanctions, the value of Russian companies were marked down to zero.

Asset Allocation

Don’t discount the benefits of what simple asset allocation can do in terms of preserving the capital of your investments and assets especially during a drawdown.

During a bull market it is clear — holding stocks, especially a globally diversified basket is a clear winner. During such periods, you may sometimes wonder why take the opportunity cost of holding assets which preserve your capital, such as bonds. You can see from the chart below when comparing pure global equities (dark blue line) vs a 60/40 mix where the 40% are global bonds (green line) - that equities are the clear winner.

However when markets start to crack and prices decline rapidly (shown in the chart below), having some preservation assets makes a big difference; from a loss of around -20% vs -40% from your starting point. The investment which has bonds (dark blue line) despite declining, holds up it value much better.

In addition, the benefits are not only confined to the perspective of saving your capital, but it also does wonders with your mental framework. This will allow you to sleep better at night and ensures that you don’t do something rash or stupid with your investments at the worst possible time.

Wealth Protection

With advancements in financial services, wealth protection structures are now more accessible to families and individuals even at lower wealth levels. You don’t need to have hundreds of millions or even billions to setup a family trust these days.

You may have the following questions or worries swirling around in your head:

How do I protect & preserve my wealth after I die?

How do I ensure my wealth is passed to the intended beneficiaries?

Are they capable in managing my assets?

How do I protect them from possible investment scams?

How do I mitigate the impact of taxes - both from wealth transfer or from overseas assets when I die?

A lot of these can be solved through the implementation of a family trust. Rather than using in-house products or solutions which may come with conflicts of interests, trusts are best done via an independent third party which supports open architecture. This way, a large array and variety of investment solutions can be utilised and it is also easily portable should you feel that the current provider no longer suits your purpose.

There are far too many books or strategies that write about how to get rich, and not enough literature on how to actually protect your riches when you get to where you want to be. However, you need not be in the dark about this. It is good to learn from the mistakes of others, such as those mentioned in the beginning of the article. If you have questions or just want to find out more, come and chat with us.